TRENDING

Popular Brands That Aren’t American

Published

2 years agoon

Many successful companies, including Apple and Starbucks, have originated in the United States and grown to become global leaders in their industries. However, the business world can be complex. Just because a company has an American origin, it does not mean it will remain American-owned.

In fact, many well-known American brands are now owned by foreign investors. Examples include Ben and Jerry’s, IBM, and Holiday Inn. Without foreign investment, these companies may not have survived.

Ben & Jerry’s

Ben & Jerry’s is an iconic American ice cream brand known for its unique flavors and pop-culture relevance. It was founded in 1978 by best friends Ben Cohen and Jerry Greenfield, in South Burlington, Vermont, and quickly became a beloved ice cream across America. In 2000, the brand was purchased by London-based conglomerate Unilever, for $326 million, who was the highest bidder among three other companies that had bid for the company. The acquisition helped to strengthen Unilever’s portfolio and furthered the growth of Ben & Jerry’s.

Burger King

Burger King is a well-known fast food chain in the United States, with a history of profitability. The company was founded in Miami, Florida in 1954 by James McLamore and David Egerton, under the name “Insta Burger King”. The company saw rapid growth and was sold for the first time only a decade later. Since then, it has changed hands several times, with the Canadian company Restaurant Brands International currently owning the brand in 2020. Restaurant Brands International merged it with Tim Horton’s, and it still receives financial backing from NYC’s 3G Capital.

Sunglass Hut

Sunglass Hut, a popular eyewear retailer with a global presence, was founded in Miami, Florida by optometrist Sanford Ziff. The company offers a wide range of glasses and shades, and has stores in multiple countries including India, the United Kingdom, and South Africa. In 2001, Luxottica Group, an Italian company, purchased Sunglass Hut for a significant sum of $653 million. At the time of the acquisition, the company operated over 1,300 stores, and now has close to 2,000 locations worldwide, with 81 of them in the United States.

Trader Joe’s

Trader Joe’s, a popular convenience store known for stocking unique and hard-to-find food items, was founded in Monrovia, California by Joe Coulombe in 1967. Coulombe’s strategy of offering unique products helped him to differentiate his store from competitors and attract customers. However, in 1979, Joe sold the store to Theo Albrecht, the owner of Aldi Nord, a large German supermarket chain. Albrecht, who is reported to be worth over $16 billion due to his successful investments, has been credited with helping Trader Joe’s to become the popular retail chain it is today.

American Apparel

American Apparel, a clothing retailer known for its “Made in USA – Sweatshop free” slogan, was founded in Los Angeles, California. The company resonated with conscious shoppers and experienced success until 2015, when it went bankrupt and struggled to recover. In 2017, Canadian company Gildan Activewear stepped in and purchased the rights to the American Apparel brand, as well as its manufacturing equipment, for a total of $88 million. This allowed the company to continue operating and helped the brand to survive. The company is now Canadian-owned and operated.

7-Eleven

7-Eleven is a well-known convenience store chain that had its origins in Dallas, Texas, in 1927. The store was originally owned by Jefferson Green who started by selling eggs, bread, and milk for Southland Ice Company. However, he soon expanded the range of products and changed the store’s name from Southland Ice to 7-Eleven, reflecting the store’s extended hours of operation. The business model proved successful and the brand expanded rapidly over the decades. However, 7-Eleven was affected by the 1987 financial crash. It was then purchased by Japanese company Ito-Yokado, and is now part of its parent company, Seven & i Holdings.

Popsicle

Popsicle, a well-known brand of frozen treats, has an interesting origin story. The recipe for the treat was created by an 11-year-old Francis Epperson from Oakland, California, who accidentally left a drink with a stick in it outside overnight and found it had frozen into a popsicle the next day. As an adult, he released the product to the public and it quickly gained popularity. However, in 1925, just three years after creating the recipe, Epperson sold the rights to the Joe Lowe company, a decision he later regretted. The Popsicle brand changed hands several times over the years, with rival company Good Humor purchasing it in 1989, which was itself a subsidiary of Unilever, making Popsicle brand British-Dutch owned.

Hellman’s

Hellman’s mayonnaise is a popular brand of mayonnaise, found in many households and is the result of recipe created by German-born Richard Hellmann in 1905. He adapted the French condiment to suit American taste and sold it in his delicatessen. Due to its popularity, he started selling it separately. By 1932, he sold it to Best Foods, where it remained for another 70 years. However, in 2000, Best Foods was purchased by Unilever for $20.3 billion, which helped in making the brand a household name that started as a simple sauce in New York City.

Dirt Devil

Dirt Devil is a well-known brand of vacuum cleaners that has been keeping American homes clean for over a century since its invention in 1905 by Philip Geier in Cleveland, Ohio. It has expanded its range over the years and sold over 25 million units, thanks in large part to its unique Cyclone system. Currently, the brand is owned by Chinese company Techtronic Industries which is also the owner of Hoover brand, making the Hong Kong-based company a major player in the household appliance market. Although it is owned by a Chinese company, the headquarters of Dirt Devil remains in Charlotte, North Carolina.

Smithfield

Smithfield Foods is a well-established company known for its pork-based products, it was founded in 1936 by Joseph W. Luter and his son in Smithfield, VA. Over the years the company has grown to become one of the largest in the industry, with over 500 farms in the United States. In 2013, Hong Kong-based company WH Group made an astronomical acquisition of Smithfield Foods for $4.72 billion. At the time, it was the most expensive acquisition made by a Chinese company in the United States. Although its headquarters is in Smithfield, Virginia, the company is now run from Luohe in Henan province, China.

Ironman

Ironman, known for its triathlon competitions, was originally a part of the Hawaii Triathlon Corporation before being purchased by Dr. James P. Gills in 1990 for $3 million. Since then, the company has grown significantly, and in 2008, it was sold to Providence Equity Securities for $85 million. In 2015, the Chinese conglomerate Dalian Wanda Group purchased Ironman for $650 million, including taking on its debt. Prior to the purchase, Ironman had already been successful but Wanda Group was particularly pleased with the 40% net growth it had seen year after year. The Headquarter of the company is still located in Tampa Bay, Florida.

Forbes

Forbes, the widely respected business and financial publication, was first published in September 1917. Over the past 102 years, it has become a trusted source for information, with definitive rankings of companies and celebrities, as well as popular lists like 30 Under 30 and World’s Most Powerful 100 Women. While Forbes is considered an American publication, and it is still operated in the US, it has not been American-owned for some time. In 2014, Chinese-based Integrated Whale Media Investments bought Forbes for around $400 million, though this change in ownership may not have been noticed by the readers. The company still operates with its headquarters in Jersey City, New Jersey.

General Motors

General Motors is America’s largest automobile manufacturer and one of the largest companies of its kind in the world. Known for its profitability and appeal. While the company is not entirely owned by a Chinese company, it does have a partnership with Shanghai Automotive Industry Corp (SAIC) that is significant for its revenue. The two companies formed a joint venture in 1998. SAIC markets and sells vehicles under the General Motors name, which many customers may not be aware of. SAIC has its headquarters in Shanghai, China, while General Motors is headquartered in Detroit, Michigan.

General Electric

General Electric (GE) is a multinational conglomerate that started out as a small brand when it was founded in 1892. However, it has since grown exponentially and diversified its operations across multiple sectors, including aviation, healthcare, power, and venture capital, becoming a large and influential company.Many Americans appreciate the GE brand because it has a “Made in America” stamp on its products. However, it should be noted that in 2016, GE sold its Appliances division to the Chinese company Haier for $5.4 billion, which was a record-breaking amount at the time. While the headquarters of GE is located in Boston, Massachusetts, the Appliances division of GE is operated by Haier out of China.

Good Humor

Good Humor is a well-known ice cream brand, particularly among older Americans who remember the company and its iconic ice cream trucks. The company was founded in Youngstown, Ohio during the 1920s and rapidly expanded to become a household name throughout the United States. In 1961, the company was purchased by Unilever, a British-Dutch multinational company, under the leadership of Thomas J. Lipton.Although Lipton ran the US division of the company, Good Humor, as a brand lost its American identity, but gained a wider range of products and retained a strong consumer base across generations. The headquarters of the company are still located in Youngstown, Ohio.

Holiday Inn

Holiday Inn is a well-known hotel chain that was founded in 1952 by Kemmons Wilson. He came up with the idea after an unsatisfying experience during a family road trip to Washington D.C. He then partnered with Wallace E. Johnson to build more locations in 1953. By the late 1980s, the well-established hotel chain was purchased by the Intercontinental Hotels Group (IHG), an England-based company. Since then, Holiday Inn locations continue to expand and are still owned and operated by IHG. The company is headquartered in Memphis, Tennessee.

Purina

Purina, originally founded in 1894 by William H. Danforth, George Robinson, and William Andrews in Nashville, Tennessee, was purchased by the Japanese company Bridgestone in December 2001 for $10.3 billion. The acquisition was made to merge Purina with Nestle’s existing pet food company, Friskies PetCare. The brand has been a staple in homes worldwide, not just in the United States.

Firestone

In 1988, Nashville, Tennessee-based tire brand Firestone chose to sell to Japanese company Bridgestone Corp for $2.6 million, or $80 per share. This helped make Bridgestone the second-largest tire manufacturer in the United States. Firestone stated that the sale would enhance shareholder value and provide employment security and career opportunities for its employees. The company had originally been offered a merger with Italian company Pirelli but declined.

Gerber

In 2007, Nestle, a Swiss company, acquired Gerber Products Company, a baby food retailer, for $5.5 billion. Gerber was originally founded in 1927 by Daniel Frank Gerber when his wife began making baby food for their daughter, Sally. Since its inception, the brand has expanded to offer a wide range of products to consumers. Gerber’s original headquarters were in Florham Park, New Jersey, prior to acquisition by Nestle. The acquisition helped Nestle capture a significant share of the global baby food market, known for its profitability.

Citgo

Citgo, a popular refiner and marketer of fuels and other products, was founded in Bartlesville, Oklahoma in 1910. In 1986, Venezuela’s state-owned company, Petróleos de Venezuela, acquired a 50% stake in Citgo, making it the parent company of the brand. Despite the acquisition, the business has faced challenges. In 2010, President Hugo Chavez announced plans to sell the company but later bonds were sold instead. In 2013, an economic depression in Venezuela, Citgo was put as collateral for debt with Russia, this caused uncertainty in its future.

The Waldorf Astoria Hotel

A stay at the historic and luxurious Waldorf Astoria Hotel in New York City is an experience in opulence. Not only is the hotel a landmark institution, but it also holds a significant place in American history. While the hotel is managed by Hilton Worldwide, it was acquired by the Chinese company Anbang Insurance Group in 2014 for a staggering $1.95 billion, making it the most expensive hotel ever sold. Under Anbang’s ownership, the hotel underwent changes, including the conversion of some rooms into condos. Anbang has also been known to have interests in other American businesses in the past, including Starwood Resorts.

Motorola

Founded in 1928, Motorola has a long history in technology and innovation. Before the advent of mobile phones, the company steadily grew and found success with its flip phones and other products. In 2012, it was purchased by Google for $12.5 billion and later in 2014, it was sold to the Chinese company Lenovo for $2.9 billion, incurring a $10 billion loss for Google. The reasons behind the move remain unclear to this day.

IBM

IBM, founded in 1911 in Armonk, New York, is a technology company with a long history. In 2004, the company’s PC division was sold to Lenovo, a Chinese company, for $1.75 billion. The acquisition was a significant milestone for Lenovo in its journey to become an international company, according to Lenovo’s CEO at the time, Chuanzhi Liu. On the other hand, IBM’s CEO at the time, Sam Palmisano, stated that the sale would strengthen IBM’s ability to capitalize on high-value opportunities in the rapidly evolving IT industry.

Legendary Entertainment Group

In 2016, Chinese investment company Dalian Wanda Group, known for its acquisition of AMC, further expanded its presence in the film industry by purchasing Legendary Entertainment Group, a movie studio based in Burbank, CA, for $3.5 billion. Dalian Wanda originally planned to fully integrate LEG into its portfolio of brands, but ultimately decided to allow the studio to continue operations as usual. Since the acquisition, Legendary Entertainment Group has produced a number of notable films including Kong: Skull Island, Pacific Rim: Uprising, Jurassic World: Fallen Kingdom, and Skyscraper.

Hoover US

Hoover, a trusted appliance brand established in Ohio in 1908, was sold in 2006 to Techtronic Industries, a China-based company, for $107 million. Despite the change in ownership, Hoover maintains a headquarters in North Carolina, but its parent company is based in Hong Kong. Techtronic Industries is a large conglomerate with over 30,000 employees and annual sales of over $7.7 billion, providing a strong platform for Hoover to continue its operations under its new ownership.

Frigidaire

Frigidaire, originally named the Guardian Refrigerator Company, was founded in 1918 in Fort Wayne, Indiana, by Nathaniel B. Wales and Alfred Mellowes with investment from William C. Durant, the founder of General Motors. In 1979, the company was acquired by the White Sewing Machine Company, which in turn was bought by Electrolux, a Swedish company, in 1986. Frigidaire has been a subsidiary of Electrolux ever since.

Strategic Hotels and Resorts

Strategic Hotels & Resorts Inc is a luxury hotel chain founded in 1997 by real estate investor and philanthropist Laurence S. Geller, it operates 17 hotels in the United States and one in Germany. In 2016, the company was purchased by the Chinese company Anbang Insurance Group for $5.5 million. The original deal was adjusted due to a property restriction placed by the US government.

Alka-Seltzer

Alka-Seltzer is a long-established over-the-counter medicine brand known for its antacid and pain relief properties. It was first introduced in 1931 by Dr. Miles Medicine Company, but later sold to the German firm Bayer in 1978. Bayer is a well-known pharmaceutical company and had partnered with GlaxoSmithKline in 2004 to promote the drug Levitra with the slogan “Strike Up A Conversation.

The Chrysler Building

The sale of the Chrysler Building in 2019 came as a surprise when it was first reported by The Wall Street Journal. The iconic New York skyscraper, known for its Art Deco design, had not been owned by an American company for some time. In 2008, the Abu Dhabi Investment Council had purchased a majority stake for $800 million, but a decade later they sold it to the Austrian company SIGNA and New York’s RFR for a little over $150 million. This significant loss made headlines in financial publications globally.

Spotify

Spotify, the popular music streaming service that was first established in 2006 in Sweden, has expanded to many new locations since its inception. The company’s original headquarters were in New York, NY, but in 2017, it joined forces with Tencent Holdings Ltd, a company based in China. The two companies purchased a stake in each other, roughly 10%, in a strategic partnership. This partnership allowed Spotify to break into the Chinese market, while Tencent further diversified its already large portfolio of companies. The partnership was seen as a convenient solution for Spotify, as it was not yet strong enough to enter the Chinese market on its own.

Tesla

Tesla, the innovative automotive company founded by Elon Musk and based in Palo Alto, CA, is not only backed by Musk, who holds the majority stake of 21.7%. It also has a variety of shareholders, one of them being Tencent Holdings Ltd, a Chinese conglomerate. Tencent Holdings is not only involved in music but a wide range of industries, including gaming and social media. It is the world’s largest video game company and one of the largest social media companies and had a net income of $95.8 billion in 2019. With such significant financial resources and expertise, Tencent is a formidable player in the industry and has contributed to the continued growth and success of Tesla.

Snapchat

Snapchat, a popular social media app known for its silly filters, was founded by Evan Spiegel and Bobby Murphy in 2011 in Los Angeles, California. The company is currently valued at over $20 billion, and in 2017, Tencent Holdings Ltd, a Chinese tech giant, purchased a 10% stake in the company for over $2 billion. With this investment, Tencent also lent its expertise to further develop Snapchat’s use of augmented reality.

Ingram Micro

Ingram Micro, a technology product distributor, was founded in 1979 in Irvine, California. Over time, it grew into a multi-billion dollar business. In the 1990s, Ingram made a strategic acquisition of Softinvest in Belgium which allowed them to distribute Hewlett Packard products and grow their business. In 2016, Chinese company HNA Technology Co. Ltd, a subsidiary of the HNA Group, purchased Ingram for $6 billion, making it one of HNA’s most profitable investments and helping Ingram expand in foreign markets.

Fidelity & Guaranty Life

Fidelity and Guaranty Life Insurance Company (F&G) provides security for millions of people. The company was initially owned by Harbinger Group, and it became public in 2013. But in 2015, China-based Anbang Insurance Group attempted to acquire F&G for $1.57 billion. However, the deal fell through, and in 2017, F&G was eventually acquired by CF Corp for an estimated $1.84 billion. The acquisition took place in Des Moines, Iowa, Fidelity and Guaranty Life Insurance Company headquarters.

Universal Music Group

Universal Music Group (UMG) is one of the world’s “Big Three” record companies, alongside Sony Music and Warner Music Group. Known for its reputation of nearly a century, it has been home to many successful musicians. However, it is no longer American-owned, as the majority stake of the company is owned by French company Vivendi for over a decade. In 2020, Vivendi reached a deal with Chinese company Tencent, which purchased a 10% stake for $33.4 billion. The company is based in Santa Monica, California.

WeWork

WeWork, a provider of shared workspaces, was founded in New York, NY about 10 years ago and has grown to manage over 4 million square meters of co-working space, benefiting from the increasing trend of flexible workspaces, especially for freelancers and startups. However, in 2016, the company faced financial difficulties and Beijing-based Legend Holdings Corp invested over $430 million into WeWork as a “new partner.” The CEO of Legend’s Hony Capital, John Zhao, said, “Our investment in WeWork is both strategic and obvious.”

Segway Inc.

Segway, a two-wheeled personal transportation device, gained popularity in recent years. In 2015, the company was purchased by Ninebot Inc, a Beijing-based company, for $80 million. Ninebot aimed to expand Segway’s presence in the robotics and technology industry and improve the technology. In 2018, plans were announced to move production from Segway’s headquarters in Bedford, New Hampshire to China, but later, it was reported that the majority of production would remain in Bedford.

John Hancock Life Insurance

The John Hancock Financial Opportunities Fund, based in Boston, Massachusetts, offers a variety of products, but one of its main offerings is life insurance. The company, founded in 1862, was acquired by Canadian company Manulife Financial in 2004. Rather than discarding the well-known John Hancock brand, Manulife decided to retain it and continue operating under the original name. Manulife is based in Toronto and has over 34,000 employees and an additional 63,000 agents.

Sotheby’s

Sotheby’s, a luxury broker of fine and decorative art, was founded in London in 1744 and later established its headquarters in New York City. In 2016, Chinese life insurance company Taikang Life Insurance Co Ltd became the majority shareholder of Sotheby’s. However, in 2019 the company was purchased by French-Israeli businessman Patrick Drahi. It is not known what happened to Taikang’s 13.5% stake or if they continue to have a partnership with Drahi.

OmniVision Technologies Inc.

In 2018, Santa Clara-based OmniVision Technologies Inc was quietly purchased by Shanghai-based Will Semiconductor Co. Ltd for over $2.1 billion. The details of the sale were not publicly announced and remain unclear. This acquisition followed the company’s involvement with Chinese investors in 2015, when a group of Chinese companies collectively invested $1.9 billion for the business. Will Semiconductor Co. Ltd is not a widely known company, making the takeover somewhat mysterious.

Hilton Hotels

In 2016, China’s HNA Group Co Ltd, a multinational conglomerate with interests in aviation and shipping, acquired a 25% stake in Hilton Hotels & Resorts for $6.5 billion. This made HNA the largest shareholder of the hotel chain, which was founded in 1919 by Conrad “Nicky” Hilton and had grown to operate 586 hotels in 85 countries by 2018. This purchase came as part of HNA’s expansion into the hotel industry and was their second acquisition that year following the purchase of Carlson Hotels Inc. At the time of the acquisition, Hilton Hotels & Resorts was valued at around $26 billion.

The Barclays Center

In 2019, Taiwanese-Canadian businessman Joseph Tsai, chairman of the Alibaba Group, completed the purchase of the Barclays Center in Brooklyn, NY. Along with the purchase of the sports and entertainment venue, Tsai also acquired the Brooklyn Nets NBA team. Upon completing the purchase, Tsai stated, “With full ownership of the Nets and Barclays Center, we will continue to bring our exciting brand of basketball to our fans. We’ve made a strong commitment to Brooklyn and it will be a privilege to present the best of Barclays Center with its great entertainment to our community.”

Brookstone Inc.

Brookstone Inc, originally a mail-order business selling specialized tools in the mid-60s, expanded to sell a variety of items such as remote control toys and alarm clocks, and by 2018, it operated 34 locations in the US. In 2014, the company filed for bankruptcy under Chapter 11, but was saved from going under completely when it was purchased for $173 million by a consortium of Chinese companies; Sanpower Group Corp, General Electric Capital Corp and Sailing Capital Management Co Ltd. As a result of this purchase and the injection of funds, Brookstone emerged from bankruptcy in July 2014.

Dairy Farmers of America

The Dairy Farmers of America (DFA), a milk marketing collective, may not be a company one would typically associate with China. However, in 2014, Inner Mongolia Yili Industrial Group Co Ltd, a Chinese company partnered with DFA to produce milk powder in a new processing plant. This partnership was established as China was facing milk shortages due to a drought in New Zealand. In order to address this issue, Inner Mongolia Yili Industrial Group expanded its international presence by partnering with DFA. The DFA is not owned by Inner Mongolia Yili Industrial Group but the two companies are closely associated.

Fab.com Inc.

In 2013, New York-based online design company Fab.com received a significant investment of around $1 billion from Tencent Holdings Ltd and its partners to help launch platforms in Asia. However, just two years later in 2015, the company was acquired by PCH International and relaunched as a wellness brand, specializing in yoga gear. The move was aimed at entering markets through strategic partners to mitigate risk and increase the likelihood of success according to CEO Jason Goldberg.

The Cleveland Cavaliers

The Cleveland Cavaliers, a basketball team established in 1970, gained support from sponsors and grew in popularity over the years. In 2019, the team received overseas investors, including Chinese businessman Jianhua Huang who led a group of investors. Huang reportedly bought a 15% stake in the team. This acquisition is not uncommon for sports clubs, especially as the Cavaliers’ star player, LeBron James, was already popular in China, as well as having previous deals with the New York Yankees and other teams in the US.

Riot Games Inc.

Riot Games, based in Los Angeles, CA, is a company best known as the creator of League of Legends, a popular multiplayer online battle game that launched in 2009. Tencent Holdings Ltd, a Chinese company, had been a partner of Riot Games for several years before increasing its involvement in 2015 by acquiring the remaining shares it did not already own, making it the parent company of Riot Games and giving it full creative control. Tencent had previously owned 93% of the company, making this move a natural progression. As of this acquisition, Riot Games is valued at $6 billion.

Uber Technologies Inc.

Uber, a San Francisco-based company that revolutionized the taxi industry by allowing users to easily book rides with the touch of a button, was founded in 2009 by Garrett Camp and Travis Kalanick and quickly grew to become a multi-billion-dollar business and a household name worldwide. In 2014, Chinese internet search giant Baidu Inc invested over $600 million to help Uber expand into the Chinese market. The partnership was mutually beneficial, as Baidu also sought to use Uber to grow its mobile payment service. The collaboration proved to be successful.

Oakley Sunglasses

Oakley, a fashion brand known for its iconic sunglasses, was founded by James Jannard in 1975 in Lake Forest, California, with an initial investment of $300. The company initially started off with eyewear but expanded to also include chin guards and ski goggles. In 1995, Oakley had its first IPO, raising $230 million. In 2007, the company was acquired by Luxottica, an Italian eyewear company and subsequently Oakley became a subsidiary of Luxottica. After the sale, Oakley’s founder James Jannard went on to create Red Digital Cinema.

Baby Trend Inc.

Baby Trend Inc, based in Fontana, CA, specializes in baby products such as high chairs, car seats, travel systems, and diaper pails. The company has continued to grow, particularly after its acquisition by Canton’s Alpha Group in 2016. This acquisition allowed Alpha to bring their innovative technology and intellectual properties into a new category and expand their expertise in the global baby and infant market. According to Wang Jing, the Vice President of Alpha, the acquisition was a way for them to offer safe, educational, and entertaining solutions to infants and their caregivers around the world.

More From Auto Overload

-

Strict Rules The Hells Angels Must Obey

-

How To Spot An American Tourist Abroad

-

Travel Hacks To Ensure A Carefree Vacation

-

Celebs & Athletes Who Aren’t As Angelic As You Thought

-

Famous Historical Landmark Construction Photos

-

He-e-e-e-re’s Johnny Carson’s Secrets From The Tonight Show

-

Commercial Actors Who Earned Millions

-

Things You Should Never Buy At Walmart

-

Most Valuable Collectors’ Items In Existence

-

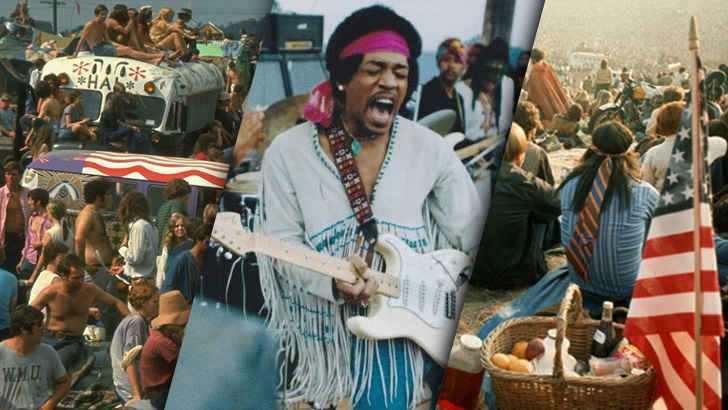

Vintage Photos From Woodstock Festival

-

How Well Do You Know The 80s?

-

Dogs That Look Like Famous People