TRENDING

Athletes Who Lost it All

Published

2 years agoon

Many professional athletes face financial struggles after their careers end, despite earning large salaries while they are playing. This can be due to a variety of factors, such as poor financial management, risky investments, and lavish spending. Some athletes may not have received proper financial education and may not have the skills or knowledge to manage their money effectively. Additionally, the high-pressure and fast-paced nature of professional sports can make it difficult for athletes to focus on their long-term financial planning.

Many athletes only have a few years, or even just a few months, to earn a significant income before they are no longer able to play due to injury or age. This can lead to a sense of urgency to earn as much as possible while they can, which can result in poor financial planning and overspending. However, others get involved in personal vices which derail their careers, making it worse. These are the most high profile athletes who had it all, then tragically lost it.

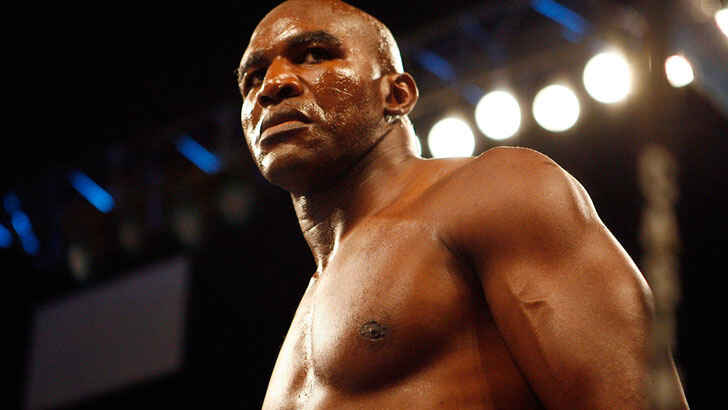

Evander Holyfield

Evander Holyfield, a former professional boxer, was the owner of a luxurious 109-room mansion in suburban Atlanta. However, according to CNBC, the bank repossessed the property after Holyfield failed to make payments on his $10 million home loan. The mansion was eventually sold to rap mogul Rick Ross for a significantly lower price than what Holyfield paid for it. The property was originally listed for $8.5 million but was sold for less than $5.9 million, according to Redfin. It is not clear what other factors may have contributed to Holyfield’s financial difficulties.

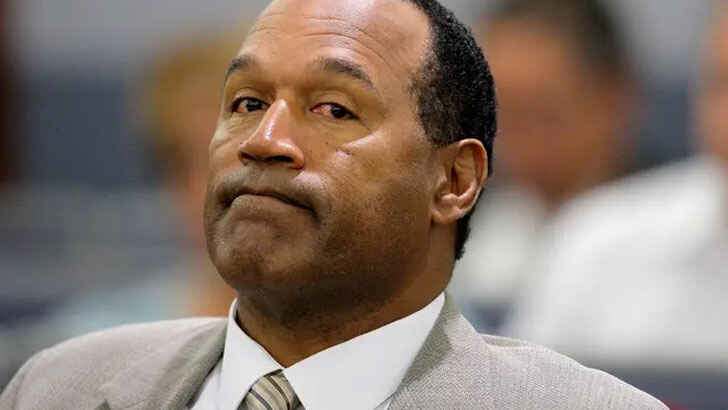

O.J. Simpson

O.J. Simpson, a former professional football player, is perhaps better known for his involvement in the high-profile murder trial in which he was accused of killing his ex-wife Nicole Brown and her boyfriend, Ron Goldman. At the time, Simpson had a net worth of $11 million, but the legal fees associated with the murder trial and subsequent civil suit, in which he was found responsible for the deaths and ordered to pay $33.5 million in compensation and punitive damages to the Goldmans, left him bankrupt. Today, Simpson is recently free from jail for unrelated charges, but financial backing isn’t on his side.

Tiger Woods

Golf pro Tiger Woods’ divorce from Elin Nordegren resulted in a significant settlement, with sources indicating that Nordegren received close to $100 million. However, this amount is a small fraction of Woods’ overall wealth, as he has earned $1.4 billion in sponsorship money alone since turning professional in 1996, according to Forbes. It is not clear what other factors may have contributed to the settlement amount or the financial details of the divorce.

Lawrence Taylor

Lawrence Taylor, a retired NFL linebacker, declared bankruptcy in the late 1990s despite earning an estimated $50 million over the course of his career. Taylor’s financial difficulties were due in part to a serious drug addiction, which led to multiple arrests for drug possession, according to Complex. In addition, Taylor admitted to spending about $1,000 daily on escort services in an interview with “60 Minutes.”

Sheryl Swoopes

Sheryl Swoopes, a former professional basketball player in the Women’s National Basketball Association (WNBA), made $50 million during her career, largely due to a lucrative Nike contract. However, she lost all of her money due to poor investment decisions and mismanagement by her lawyers and agents, according to Money. In 2004, Swoopes filed for Chapter 13 bankruptcy.

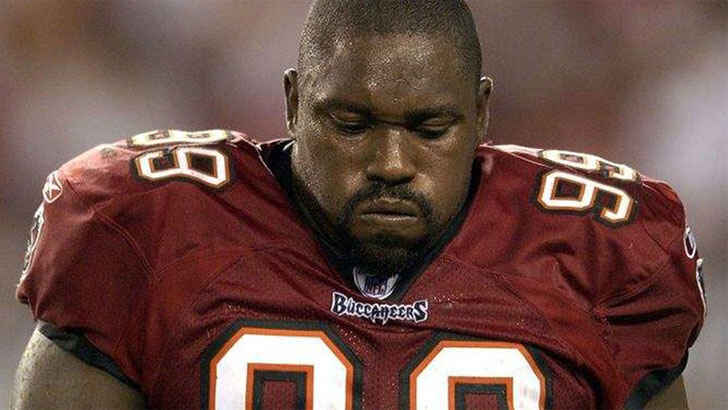

Warren Sapp

Warren Sapp played in the National Football League (NFL) for 13 years, earning an estimated $40 million during his career, according to Bleacher Report. Despite this substantial income, Sapp ended up $6.7 million in debt, as stated in a bankruptcy filing he made in 2012. It appears that Sapp’s financial difficulties were due to overspending, as his asset list included 240 pairs of Jordan shoes worth over $6,000, a watch worth $2,250, and a lion-skin rug worth $1,200.

Curt Schilling

Curt Schilling, a former Major League Baseball pitcher, lost all of the $50 million he had invested in his video game company, 38 Studios, when the company declared bankruptcy in 2012, according to ABC News. In an interview with radio station WEEI-FM, Schilling stated that all of the money he had earned and saved during his baseball career was gone, as he had put everything he had into the company. He added that while he believed in the company, he was not seeking sympathy and that it was his choice to make the investment. It is not clear what other factors may have contributed to the financial difficulties of 38 Studios.

John Daly

Golfer John Daly has a love for gambling that has cost him millions of dollars. In an interview with ESPN, he estimated that he lost around $50 million gambling, stating that he had lost about $98 million and won about $45 million. Safe to say that gambling is not Daly’s forte, and likely forced him to play golf much longer than he was anticipating.

Mark Brunell

Mark Brunell, a former NFL player, lost the $50 million he earned throughout his career through investments in failed businesses. According to Action News in Jacksonville, Florida, Brunell invested in nine businesses and enterprises, five of which went bankrupt. One of Brunell’s biggest financial losses was a company called Champion LLC, which purchased high-end investment properties. When the real estate market crashed, Brunell lost everything he had invested in the company and ended up owing more due to loans taken out to buy the properties.

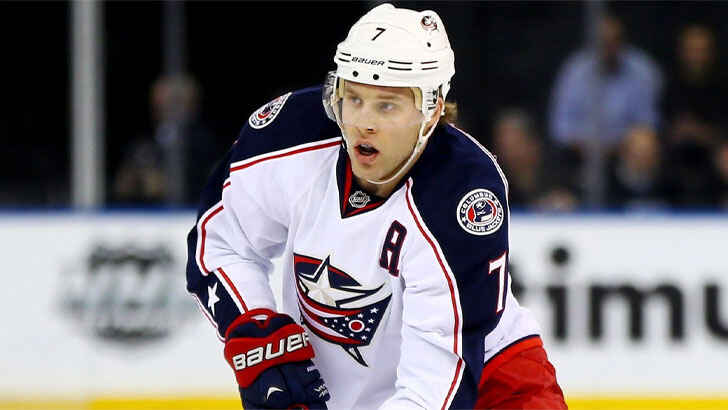

Jack Johnson

Jack Johnson, a professional hockey player, signed a seven-year, $30.5 million contract with the Columbus Blue Jackets in 2011. However, due to financial mismanagement by his parents, he was left with nothing and was forced to declare bankruptcy. According to court documents, his parents took out loans against Johnson’s future earnings, including at least $15 million across 18 high-interest loans, which resulted in multiple defaults. They also allegedly purchased a beach house in California, bought cars, and paid for travel to see Johnson play, as reported by Forbes. Johnson was not aware of all the purchases made in his name and was sued several times for defaulting on loan payments.

Vince Young

Vince Young, a former NFL quarterback, signed a $25 million contract with the Tennessee Titans in 2006. However, just seven years later, he filed for Chapter 11 bankruptcy, according to Sports Illustrated. Young admitted to not paying attention to how his money was being used throughout his career, instead trusting his financial advisor and his uncle to make decisions for him. He was also known for his generosity, purchasing two cars for a relative, building a house for his mother, and treating his teammates to a $15,000 meal at the Cheesecake Factory. These expenses may have contributed to Young’s financial difficulties.

Floyd Mayweather

Floyd Mayweather, a professional boxer known for calling himself “Money,” faced financial difficulties in 2015 when the Internal Revenue Service (IRS) issued a lien against him for unpaid taxes. According to Deadspin, Mayweather claimed that he did not have enough money to pay the IRS the $22.2 million he owed in taxes for the year, despite earning $200 million for a single fight. In response, he requested an extension to pay back the taxes.

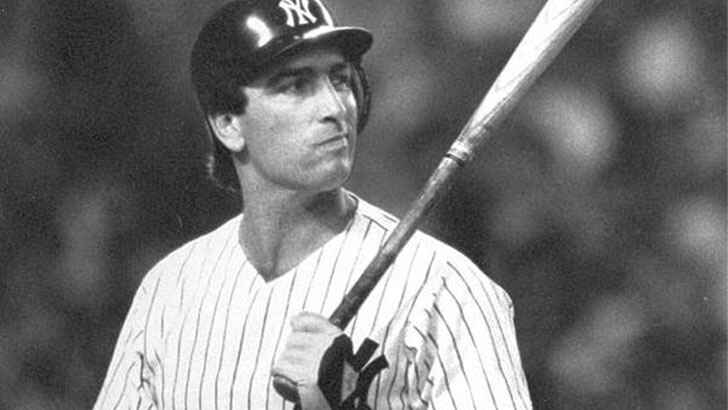

Jack Clark

Jack Clark, a former player for the Boston Red Sox, had a successful career in MLB from 1975 to 1992. However, in 1992, the same year he retired from professional baseball, he filed for bankruptcy, citing $6.7 million in debt. According to Sports Illustrated, Clark’s bankruptcy filing stated that he owned 18 cars, including a Ferrari worth $717,000. It is possible that Clark’s love for luxury cars may have contributed to his financial difficulties.

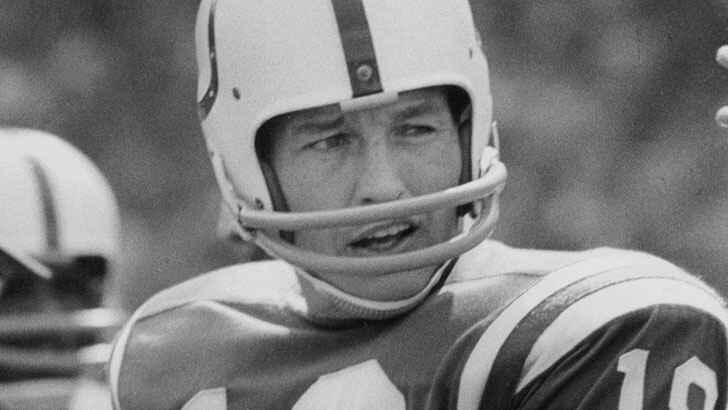

Johnny Unitas

Johnny Unitas, a former Baltimore Colt quarterback, made a poor investment that ultimately led him to file for Chapter 11 bankruptcy in 1991. According to The Baltimore Sun, his bank attempted to collect on almost $4 million in failed loans that Unitas and his business partners had taken out in the mid-1980s to purchase a circuit board manufacturing company called National Circuits. Unitas and his partners bought National Circuits for $3.5 million in 1994, but by 2000, they were only able to sell it for $1 million, as reported by Forbes. This financial failure contributed to Unitas’ bankruptcy filing.

Brian Trottier

Bryan Trottier, a former professional hockey player who won six Stanley Cup championships, filed for bankruptcy in 1994 with very little in assets (less than $150,000) and a large amount of debt (nearly $9.5 million). According to The New York Times, some of Trottier’s debts were owed to investors in his ice-rink business, BT Skating Corp., which went into foreclosure. It is not clear what other factors may have contributed to Trottier’s financial difficulties.

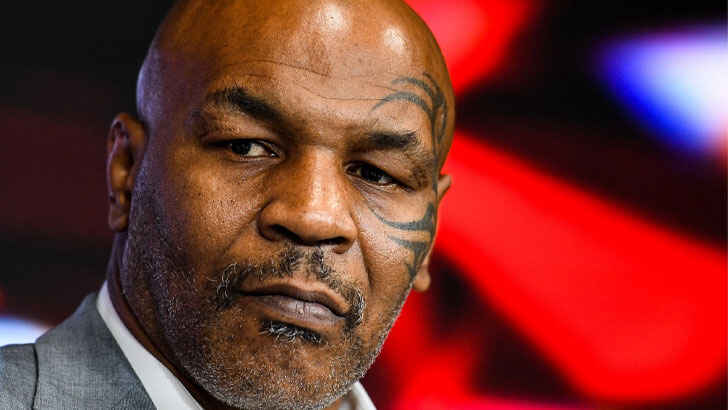

Mike Tyson

Mike Tyson, a former heavyweight champion boxer, made a significant amount of money during his career, earning approximately $400 million over 20 years in and out of the ring. However, he reportedly squandered his wealth through excessive spending on luxury items such as jewelry and Siberian tigers, according to The New York Times. In 2003, Tyson filed for Chapter 11 bankruptcy, stating that he had accumulated $23 million in debt, including $13.4 million owed to the Internal Revenue Service (IRS).

Michael Vick

In 2007, former NFL quarterback Michael Vick pleaded guilty to federal charges in relation to an illegal dog fighting operation. As a result, the Atlanta Falcons, the team he played for at the time, sought to recover nearly $20 million in bonus money they had paid him between 2004 and 2007, alleging that Vick had used the money to finance his illegal activities. In 2008, a judge ruled that Vick could keep all but $3.75 million of the bonus money, stating that recovering all of the bonuses would violate the NFL’s collective bargaining agreement, as reported by ESPN.

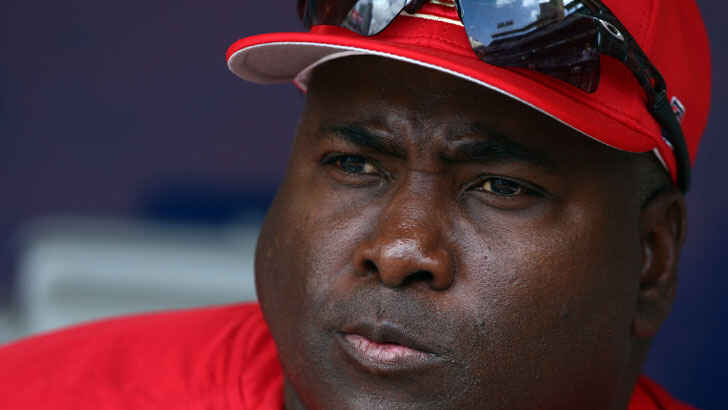

Clinton Portis

Clinton Portis, a former running back for the Washington Football Team and the Denver Broncos, signed a lucrative contract in 2004 that made him the highest-paid running back in NFL history at the time, according to Sports Illustrated. However, by 2009, Portis had filed for Chapter 11 bankruptcy and was essentially penniless. In an interview with Sports Illustrated, Portis attributed his financial downfall to trusting the wrong people, including his financial advisor, Jeff Rubin, who convinced him to invest $1 million in an Alabama casino that was shut down by state regulators in 2012. Portis said that a total of $3.1 million was taken from his account by Rubin.

Allen Iverson

Allen Iverson, a former NBA star, is reported to have made an estimated $154 million in career earnings. However, in 2012, a judge ruled that his checking account would be garnished after he failed to pay back $662,540 in debt and interest to a jeweler, leading to widespread reports that he was either struggling financially or in debt. Philadelphia Inquirer reporter Bill Lyon has noted that Iverson’s lavish spending habits, such as hiring a personal hairstylist to travel with him and paying for entertainment for his entourage, may have contributed to his financial troubles.

Dan Marino

Dan Marino, a former player for the Miami Dolphins and an NFL analyst, had a significant investment in Digital Domain Media Group, a digital production company that was founded by James Cameron and produced the digital effects for movies such as “Titanic” and “Transformers.” Marino owned 1.6 million shares in the company, which were once worth $14 million. However, after Digital Domain Media Group declared bankruptcy, the value of Marino’s investment dropped to $850,000, according to Sports Grid. It is not clear what other factors may have contributed to the company’s financial difficulties.

Bernie Kosar

Bernie Kosar, a former professional football quarterback, signed a $6 million contract with the Cleveland Browns in 1985 and entrusted his father with managing his finances. However, Kosar later discovered that his father had used his signing bonus to pay for his own mortgage and buy cars, according to the book “Is There Life After Football?” In addition to this mismanagement of funds, Kosar also lost money due to loans he gave to friends and family that were never repaid, as well as poor investments that were recommended by friends and family. As a result, Kosar ended up losing a total of $15 million.

Antoine Walker

Antoine Walker, a former NBA player, declared personal bankruptcy in 2010 after spending or losing all $110 million of his career earnings, as well as additional millions he had earned from endorsement deals. According to Sports Illustrated, Walker’s financial difficulties were the result of a lavish lifestyle, bad real estate investments, gambling losses, and financially supporting numerous friends and family members. At one point, Walker reportedly had 30 to 70 friends and family members on his payroll.

Luther Ellis

Luther Elliss had a successful career playing in the NFL for 10 years, during which he earned $11.6 million in a five-year span. However, by 2010, he was struggling financially and relying on help from friends in his church to pay his bills and even afford food, according to the Deseret News. In 2009, Elliss filed for bankruptcy, citing a number of factors that contributed to his debt, including a $1.6 million mortgage loan and overspending on cars and jewelry. However, he told the Deseret News that poor business decisions were the primary cause of his multimillion-dollar loss.

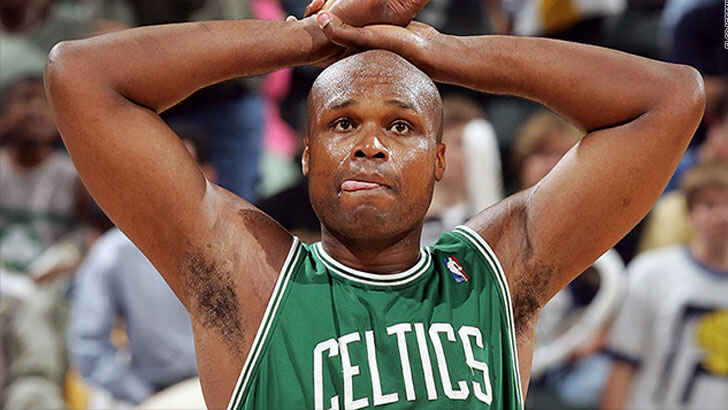

Latrell Spreewell

Latrell Sprewell was an NBA player who had a successful career that spanned over a decade. However, after his retirement, he faced financial struggles that were widely publicized in the media. In 2004, it was reported that Sprewell had lost most of his $96 million fortune and was struggling to make ends meet. He was forced to sell his luxury yacht and several of his properties, including his mansion in Milwaukee. Sprewell also faced legal issues, including a lawsuit in which he was ordered to pay over $300,000 in back child support. Despite these struggles, Sprewell has remained active in charitable work and has continued to be involved in the basketball community.

Lance Briggs

Lance Briggs, a former Chicago Bears linebacker, had a successful career playing in the NFL for 12 years before retiring in 2015. However, he faced financial challenges after his playing days were over. In 2008, he purchased a large, luxurious mansion in Northfield, Illinois for $2.3 million, but according to the Chicago Tribune, he lost the property to foreclosure in 2017. Crain’s Chicago Business also reported that a townhouse owned by Briggs went into foreclosure that same year. The mansion was eventually sold in January 2020 for only $1.1 million, which was less than half of what Briggs had paid for it.

Diego Maradona

Diego Maradona, a famous soccer player from Argentina, participated in four consecutive World Cups and finally won the championship in 1986 with a controversial goal. Despite making a good income as a professional soccer player, Maradona had a history of not paying taxes. In 2009, the Italian Tax Authority demanded that Maradona pay a back tax amount of $54 million, which left him financially distressed and forced to file for bankruptcy.

Lenny Dykstra

Lenny Dykstra, a former professional baseball player for the Mets, not only experienced financial ruin, but also served time in jail. He was sentenced to three years in state prison for grand theft auto. Dykstra filed for bankruptcy in 2009, stating that he owed more than $31 million with only $50,000 in assets. After filing for bankruptcy, federal prosecutors allege that Dykstra sold approximately $400,000 worth of items from his $18.5 million mansion, which he had purchased from professional hockey player Wayne Gretzky.

Dorothy Hamill

In the 1970s, Dorothy Hamill became a well-known figure in the world of ice skating, winning a gold medal at the 1978 Olympics. She later performed with the Ice Capades in the 1980s and became one of the most iconic skaters in history. Despite earning a significant amount of money from her career, endorsements, and other ventures, Hamill filed for Chapter 11 bankruptcy in 1991 and found herself hurting. She had invested a lot of money in various ventures and also incurred expenses related to court costs for a custody battle over her daughter, treatment for depression, and medical costs when she was diagnosed with breast cancer.

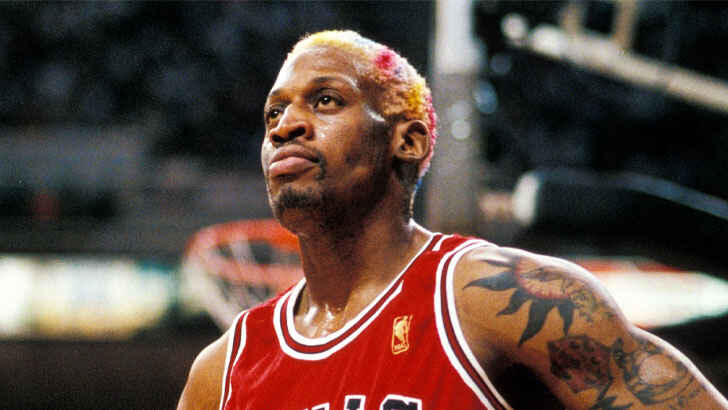

Dennis Rodman

Former NBA player Dennis Rodman, best known for his time with the Chicago Bulls, filed paperwork in court claiming that he could not make his back child support or spousal support payments due to being sick and poor. He owed $800,000 in back child support and $50,000 in back spousal support. Despite his reputation as one of the most flamboyant and distracting players in the NBA, Rodman amassed significant wealth through his NBA contracts and various other ventures, including TV shows, advertisements, endorsements, and movies.

Terrell Owens

Terrell Owens admitted on “Dr. Phil” in 2012 that he had lost all of the $80-100 million he had earned during his NFL career. In an interview with GQ, Owens explained that he had been too trusting of others who gave him investment advice, leading to a series of risky investments and real estate holdings that lost their value following the market collapse in 2008. Unlike other athletes who went bankrupt due to lavish spending on cars and homes, Owens attributed his financial difficulties to poor investment decisions.

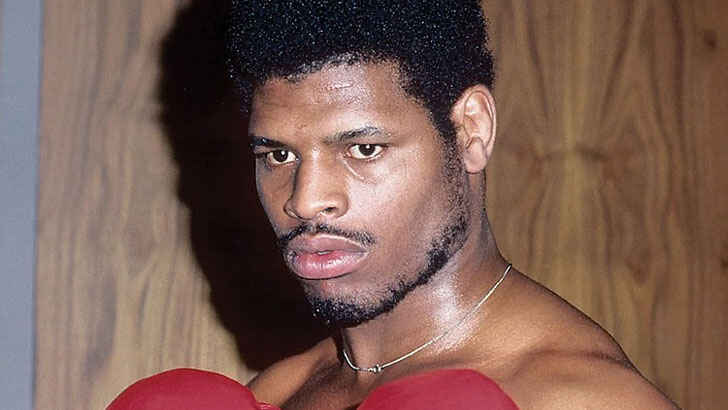

Leon Spinks

Leon Spinks, a former heavyweight boxing champion, earned approximately $4.5 million during his career. After defeating Muhammad Ali in 1978, his career reached its peak, but less than 20 years later, he was poor and homeless. Spinks admitted to spending his earnings extravagantly, primarily on drugs, and also had numerous legal issues. He was last reported to be working as a janitor at a YMCA in Columbus, a far cry from his former position as a top professional athlete.

Darren McCarty

During his career with the Detroit Red Wings, McCarty made some poor business decisions that led him to file for bankruptcy a few years ago, resulting in the loss of the over $15 million he earned as a professional hockey player. McCarty claimed that he owed $6 million to creditors, and despite his success as a player, he found himself bankrupt and in a much worse financial position just a few years into his retirement.

Travis Henry

The NFL running back, who played for multiple teams, experienced a significant financial decline, partially due to fathering nine children with nine different women, some of whom had children in close proximity to each other. This situation led to financial ruin and left Henry in hard times for the oncoming number of years.

John Arne Riise

The young soccer player filed for bankruptcy and became involved in a dispute with his former agent, Einar Baardsen, over the alleged poor management of his finances and investments. Reports indicate that the player owed over 100,000 pounds in debt, even though it is said that he earned 50,000 pounds per week. Baardsen stopped representing the player in 2005, and the matter was still being resolved.

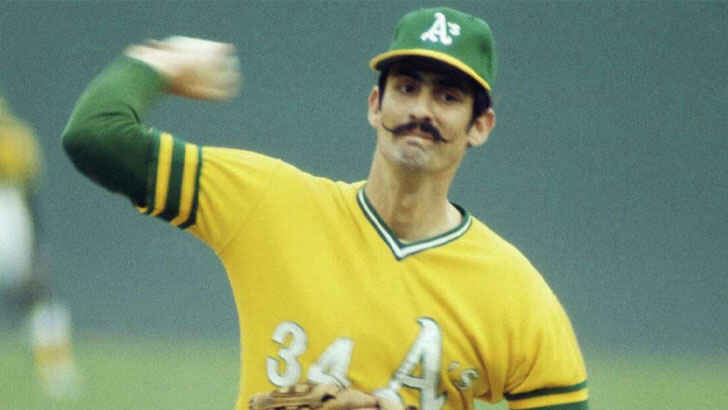

Rollie Fingers

Rollie Fingers, a professional baseball player who played for the Milwaukee Brewers as a free agent in the 1979s, filed for bankruptcy in 1978 due to reports of needing cash to pay for his rent and food for his four children. He made a series of poor investments and was involved in business scams that caused him to lose $1.1 million. Like many other professional athletes, Fingers found himself struggling and was forced to sell his line of Arabian horses, which he had purchased and owned, for $5,000 to help pay off his debts. The bank intervened and sold the horses to help cover the debt Fingers owed.

Deuce McCallister

Deuce McCallister had a successful career as a running back for the New Orleans Saints in the NFL, earning millions of dollars during his time with the team. However, McCallister made some poor investment decisions that cost him a significant amount of money and left him financially ruined. His home was seized by the St. Charles Parish Sheriff’s Office and auctioned off, and he was sued by Whitney National Bank, the bank holding his mortgage, for allegedly owing $1.8 million on the mortgage. McCallister also lost his Nissan dealership in Jackson, Mississippi when it filed for bankruptcy, leaving him struggling to stay afloat financially.

Tony Gwynn

Tony Gwynn, a successful professional baseball player who was inducted into the Baseball Hall of Fame in 2007, had financial troubles in the past, including filing for Chapter 7 bankruptcy in 1987 due to poor business and investment management. The Gwynn Family Foundation, established in 1995 to provide financial and educational resources to underserved members of the San Diego community, had issues with state regulations in 2000 and 2015 and faced numerous lawsuits in the 1990s concerning the Gwynns’ businesses.

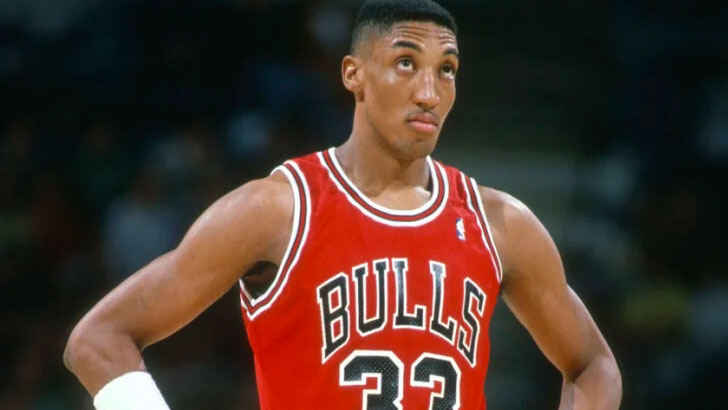

Scottie Pippen

Scottie Pippen, an NBA legend, earned approximately $109 million in NBA salary, but was deceived by a financial advisor who took a significant portion of his savings, totaling $20 million. Pippen experienced financial difficulties and was cheated out of a total of $27 million, including a $1.4 million loan. The financial advisor in question was recommended by the Chicago Bulls, and Pippen was forced to sell his house in 2005. Although he did not officially declare bankruptcy, Pippen was struggling for a number of years before recovering financially.

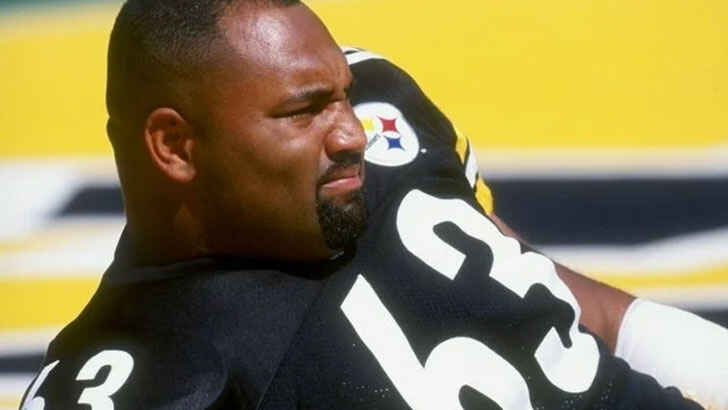

Dermontti Dawson

Dermontti Dawson, a former center for the Pittsburgh Steelers, filed for bankruptcy in 2010 with liabilities totaling nearly $70 million and assets of just $1.4 million, according to NBC Sports. The majority of Dawson’s debt was owed to business partners, primarily in real estate investments. In a statement to NBC Sports, Dawson explained that the current real estate market and economic conditions, as well as his ownership of non-controlling minority interests in the entities that owned the real estate, left him with limited options. He expressed regret about the outcome of the situation.

Björn Borg

Bjorn Borg was a successful tennis player who won 11 Grand Slam titles in the Open era, including five Wimbledons in a row and several French Open titles. He earned over $3.6 million in prize money and millions more in endorsements. After retiring in 1984, Borg’s investment in the fashion industry failed, leading his company to go bankrupt. He sold his trophies at an auction, but his brand was later purchased for around €13 million.

George Best

George Best, a former Manchester United and Northern Ireland footballer, was considered one of the greatest players of his time, but he struggled with money management. Despite earning an estimated $100 million in his lifetime, Best admitted to “squandering” much of it on cars, women, and alcohol, as well as battling alcoholism that ultimately required a liver transplant. Best’s son Calum also faced financial difficulties and filed for bankruptcy due to his hard-partying lifestyle.

Riddick Bowe

Riddick Bowe, a former professional boxer with only one loss on his record, earned millions through fight purses and endorsements from companies like FILA after becoming the undisputed heavyweight champion of the world at the age of 24. However, Bowe eventually ended up selling his own autographed memorabilia at a flea market in New Jersey. He admitted to spending money extravagantly on luxurious homes, cars, and helping out friends and family, but also claimed that his money was mismanaged by advisers. Bowe’s boxing nickname was ironically “Sugar Man.”

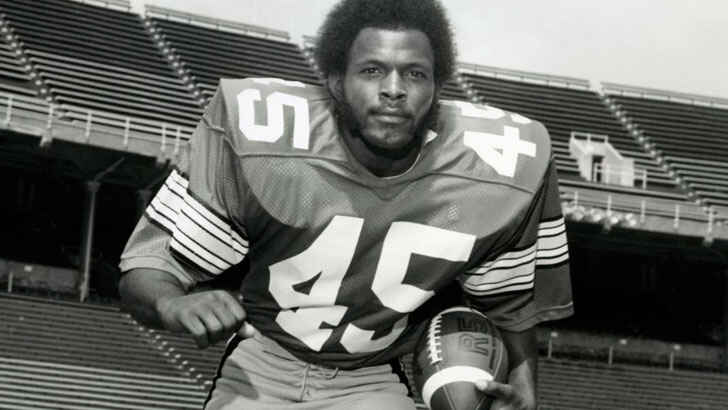

Archie Griffin

Archie Griffin, a former professional football player, experienced financial difficulties during his career, including filing for personal bankruptcy after some failed business ventures. Along with his brother, Ray Griffin, and other members of the Cincinnati Bengals, Griffin filed for bankruptcy after a three-year venture involving six athletic shoe stores that resulted in debts of over $500,000. In an interview with the New York Times in 1982, Griffin stated that he would be more cautious in the future and only enter into a business that he could manage personally.

Bill Johnson

Bill Johnson was a successful downhill skier who won the gold medal in the 1984 Winter Olympics. After retiring from competitive skiing, he faced financial difficulties and filed for bankruptcy in 1995. In the years following his bankruptcy, Johnson struggled with addiction and mental health issues, and in 2013, he was arrested for domestic violence. In 2015, he suffered a severe brain injury in a fall and was placed in a long-term care facility.

Billy Sims

Billy Sims was a successful professional football player who played for the Detroit Lions and was named the NFL Rookie of the Year in 1980. After retiring from football, Sims faced financial difficulties and filed for bankruptcy in 1988. In the years following his bankruptcy, Sims struggled with addiction and legal issues. In 1992, he was sentenced to prison for drug trafficking and was released in 1995. In more recent years, Sims has worked to overcome his addiction and has become a motivational speaker.

Andre Rison

Andre Rison was a successful professional football player who played for several teams in the NFL, including the Atlanta Falcons and the Indianapolis Colts. After retiring from football, Rison faced financial difficulties and filed for bankruptcy in 2007. In the years following his bankruptcy, Rison struggled with legal issues, including charges for failing to pay child support. He has also faced criticism for his relationships with high-profile women, including his marriage to Lisa Salters, a ESPN journalist.

Al Cowlings

In the aftermath of the circumstances which saw him being the one to drive O.J. Simpson’s white Bronco in the infamous car chase, Cowlings returned to football before filing bankruptcy in 1997. This was probably attributed to his tainted reputation and the fallout he had emotionally and financially after going through such a high profile case. He did recover, however, later playing professional golf and eventually working as a TV broadcaster.

Steve Howe

Steve Howe was a successful professional baseball player who played for several teams in MLB. However, he struggled with substance abuse and was suspended from the MLB multiple times for violating the league’s substance abuse policy. In 2006, Howe died in a car accident, which was believed to be related to his substance abuse problems. Prior to his death, Howe had filed for bankruptcy and struggled financially, likely from involvement with drugs.

Terry Long

Terry Long was a professional football player who played for the Pittsburgh Steelers. In 1991, he was suspended by the NFL for using steroids and later admitted to using them during his career. In 2005, Long committed suicide, and it was later revealed that he had suffered from depression and had financial difficulties, including filing for bankruptcy.

Wally Backman

Wally Backman is a former professional baseball player who played for several teams in MLB. After retiring from baseball, Backman became a manager for various minor league teams and was briefly the manager of the New York Mets in 2004. However, he was fired from the position after it was revealed that he had a criminal record and had faced financial difficulties, including filing for bankruptcy. In more recent years, Backman has continued to work as a manager in the minor leagues.

Bill Buckner

After his playing career ended, former All-Star first baseman Bill Buckner experienced further financial troubles when the car dealership he had invested in closed just two years after opening. This was in addition to the bad luck he had experienced with his infamous blunder in Game 6 of the 1986 World Series.

More From Auto Overload

-

Most Iconic Celeb Role Commitments

-

Childhood Crushes Then And Now

-

Discontinued Foods We All Miss

-

Incredible Footage Caught On Trail Cams

-

Cameras Captured The Most Interesting Photos From Walmart

-

Odd Things You Only See At Walmart

-

The Fastest Growing Cities In The U.S.

-

25 Facts About Air Force One

-

Wonderous Nature Photos

-

Celebs & Athletes Who Aren’t As Angelic As You Thought

-

The Most Unique People in the World

-

Meghan And Harry’s Interview Just Changed Everything – Here’s Why